【bxh vdqg nauy】Lawmakers propose extension of VAT rate cut to buoy recovery

Lawmakers propose extension of VAT rate cut to buoy recovery

May 26,bxh vdqg nauy 2024 - 11:19 |

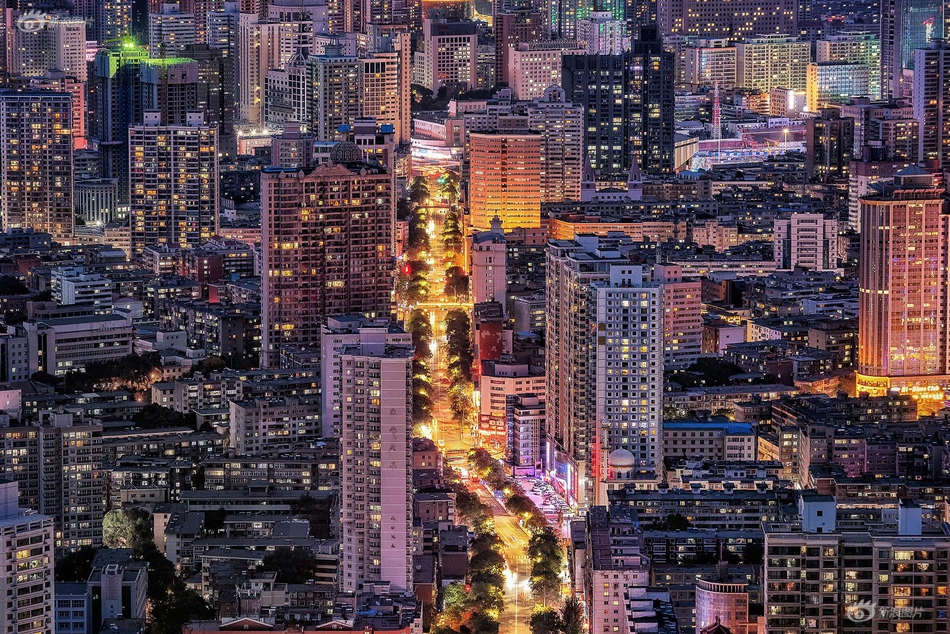

| The National Assembly discussed the supervisory delegation’s report and a draft NA resolution on results of the supervision over the implementation of the NA’s Resolution No. 43/2022/QH15, dated January 11, 2022, on the fiscal and monetary policies supporting the socio-economic recovery and development programme, and of the NA’s resolutions on some nationally important projects through 2023. — VNA/VNS Photo |

HÀ NỘI — Some legislators on Saturday proposed the two per cent reduction in value-added tax (VAT) under a resolution of the National Assembly (NA) be extended to continue supporting the country's socio-economic recovery and development.

As part of the ongoing 7th session, the NA held a plenary sitting to discuss a supervisory delegation’s report and a draft NA resolution on results of the supervision over the implementation of the NA’s Resolution No. 43/2022/QH15, dated January 11, 2022, on the fiscal and monetary policies supporting the socio-economic recovery and development programme, and of the NA’s resolutions on some nationally important projects through 2023.

Participants shared the view that Resolution 43 is a right and timely move significantly contributing to the COVID-19 fight and socio-economic recovery and development.

Dương Khắc Mai, a deputy from the Central Highlands province of Đắk Nông, highly valued the resolution implementation, saying the fiscal policy applied under Resolution 43 has helped enterprises and business households in the province to quickly recover and develop production and business activities, boost growth drivers, reduce expenses, improve their proactiveness and benefit from favourable conditions.

He held that the 2 per cent VAT rate cut under this resolution has shown positive and direct impacts on society, helping reduce production costs, guarantee social security and assist with people’s life.

Echoing that view, Trần Anh Tuấn, a deputy from the HCM City delegation, said the VAT rate cut is among the successful policies that have benefited the economy.

Apart from helping stimulate demand and aid enterprises’ operations, it has also contributed to an increase in corporate income tax revenue, he said, proposing the policy continue in the time ahead.

Deputy Dương Văn Phước representing the central province of Quảng Nam suggested the NA issue more mechanisms and policies to keep assisting with socio-economic recovery and development, as well as more measures for tackling institutional barriers to facilitate investment resources for production and business activities.

Meanwhile, the Government should keep adopting flexible fiscal and monetary policies while pressing on with comprehensive solutions to the difficulties facing the financial, monetary, corporate bond and real estate markets.

He also suggested ministries and central agencies further simplify procedures and provide optimal conditions for people and enterprises to access resources to foster production and business activities.

Talking about the issues of deputies’ concern, Minister of Planning and Investment Nguyễn Chí Dũng said Resolution 43 was built in a particularly challenging context when economic growth was slowing down significantly, enterprises facing numerous difficulties, and global supply chains disrupted, requiring urgent solutions to support enterprises and people to stabilise their life and gradually shore up socio-economic aspects.

He also mentioned direct cash transfers as a measure to support the people, that can immediately boost consumption and go into the economy.

The Prime Minister, the Government, ministries and sectors have issued many legal and guidance documents for the resolution implementation and set up many working groups to promote implementation, Minister Dũng said, adding that legislators’ opinions will be considered to improve the drafting and implementation of policies. — VNS

(责任编辑:Nhận Định Bóng Đá)

- ·Kỳ vọng thanh khoản chứng khoán sớm đảo chiều

- ·Không áp dụng Luật Đấu thầu để chọn nhà thầu ký kết hợp đồng về dầu khí

- ·Vùng Đông Nam Bộ thí điểm phân cấp, phân quyền trong lĩnh vực tài chính, đất đai, tổ chức bộ máy

- ·Những chính sách kinh tế có hiệu lực từ tháng 5/2021

- ·Phó chủ tịch xã kể giây phút người chồng tử vong khi cứu vợ con bị nước cuốn

- ·Quy định mới khi lắp điện mặt trời mái nhà

- ·Giám sát mối nguy ô nhiễm thực phẩm tại một số chợ biên giới tỉnh Quảng Ninh năm 2021

- ·Kinh tế phục hồi, hoạt động M&A sẽ được kích hoạt mạnh mẽ

- ·iPhone 8, iPhone 7S đang được đưa vào sản xuất hàng loạt

- ·Tiền vệ gốc Scotland giúp Malaysia thắng ngược Indonesia

- ·Vụ chuyến bay giải cứu: Ông Nguyễn Anh Tuấn khai chạy án vì thương người

- ·Khởi công dự án linh kiện điện tử 200 triệu USD và dự án chỉnh trang sông Tam Bạc hơn 557 tỷ đồng

- ·Doanh nghiệp châu Âu quan tâm đầu tư ở Tây Nguyên

- ·Hà Nội xử phạt hơn 8 tỷ đồng sau hơn một tuần giãn cách

- ·Nhu cầu iPad tăng vọt, không đủ để giao hàng

- ·Đại học Tân Tạo lại thua kiện, phải trả học phí thu vượt cho sinh viên

- ·Thống nhất trình Quốc hội điều chỉnh kế hoạch vốn vay lại năm 2022 của nhiều địa phương

- ·Hơn 100 vận động viên tham gia Giải vô địch vật tay TP.Dĩ An mở rộng lần I

- ·Kiểm tra ma tuý tài xế vụ tai nạn khiến 3 người CLB HAGL tử vong

- ·Thành phố Nam Định đầu tư 1.200 tỷ đồng xây dựng cầu qua sông Đào