【soi kèo munich】Lawmakers propose extension of VAT rate cut to buoy recovery

Lawmakers propose extension of VAT rate cut to buoy recovery

May 26,soi kèo munich 2024 - 11:19 |

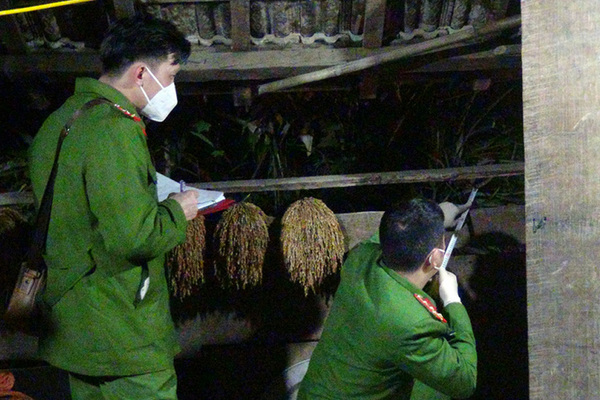

| The National Assembly discussed the supervisory delegation’s report and a draft NA resolution on results of the supervision over the implementation of the NA’s Resolution No. 43/2022/QH15, dated January 11, 2022, on the fiscal and monetary policies supporting the socio-economic recovery and development programme, and of the NA’s resolutions on some nationally important projects through 2023. — VNA/VNS Photo |

HÀ NỘI — Some legislators on Saturday proposed the two per cent reduction in value-added tax (VAT) under a resolution of the National Assembly (NA) be extended to continue supporting the country's socio-economic recovery and development.

As part of the ongoing 7th session, the NA held a plenary sitting to discuss a supervisory delegation’s report and a draft NA resolution on results of the supervision over the implementation of the NA’s Resolution No. 43/2022/QH15, dated January 11, 2022, on the fiscal and monetary policies supporting the socio-economic recovery and development programme, and of the NA’s resolutions on some nationally important projects through 2023.

Participants shared the view that Resolution 43 is a right and timely move significantly contributing to the COVID-19 fight and socio-economic recovery and development.

Dương Khắc Mai, a deputy from the Central Highlands province of Đắk Nông, highly valued the resolution implementation, saying the fiscal policy applied under Resolution 43 has helped enterprises and business households in the province to quickly recover and develop production and business activities, boost growth drivers, reduce expenses, improve their proactiveness and benefit from favourable conditions.

He held that the 2 per cent VAT rate cut under this resolution has shown positive and direct impacts on society, helping reduce production costs, guarantee social security and assist with people’s life.

Echoing that view, Trần Anh Tuấn, a deputy from the HCM City delegation, said the VAT rate cut is among the successful policies that have benefited the economy.

Apart from helping stimulate demand and aid enterprises’ operations, it has also contributed to an increase in corporate income tax revenue, he said, proposing the policy continue in the time ahead.

Deputy Dương Văn Phước representing the central province of Quảng Nam suggested the NA issue more mechanisms and policies to keep assisting with socio-economic recovery and development, as well as more measures for tackling institutional barriers to facilitate investment resources for production and business activities.

Meanwhile, the Government should keep adopting flexible fiscal and monetary policies while pressing on with comprehensive solutions to the difficulties facing the financial, monetary, corporate bond and real estate markets.

He also suggested ministries and central agencies further simplify procedures and provide optimal conditions for people and enterprises to access resources to foster production and business activities.

Talking about the issues of deputies’ concern, Minister of Planning and Investment Nguyễn Chí Dũng said Resolution 43 was built in a particularly challenging context when economic growth was slowing down significantly, enterprises facing numerous difficulties, and global supply chains disrupted, requiring urgent solutions to support enterprises and people to stabilise their life and gradually shore up socio-economic aspects.

He also mentioned direct cash transfers as a measure to support the people, that can immediately boost consumption and go into the economy.

The Prime Minister, the Government, ministries and sectors have issued many legal and guidance documents for the resolution implementation and set up many working groups to promote implementation, Minister Dũng said, adding that legislators’ opinions will be considered to improve the drafting and implementation of policies. — VNS

(责任编辑:Thể thao)

- ·Website sân bay Tân Sơn Nhất và Rạch Giá bị hack

- ·Bắt thêm 1 nghi phạm vụ dân quân tự vệ bị giết, cướp tài sản ở An Giang

- ·Năn nỉ về sống chung không được, cô gái rút dao đâm người yêu tử vong

- ·Hai cựu Chủ tịch Khánh Hòa bị đề nghị 5

- ·Vợ chồng ngủ riêng, đừng nghĩ đơn giản là sở thích!

- ·DN FDI không được tổ chức gom hàng để XK

- ·Bắt nhóm đối tượng nổ súng bắn người trên đường phố Yên Bái

- ·Rùng mình tội ác của người vợ 'bắt tay' tình nhân sát hại chồng

- ·Lý do dừng đấu giá giữa chừng biển số ô tô 65A

- ·Thúc đẩy hợp tác đầu tư Việt Nam

- ·Website sân bay Tân Sơn Nhất và Rạch Giá bị hack

- ·Cựu nữ nhân viên quỹ tín dụng xã lừa gần 20 người chiếm đoạt hàng chục tỷ đồng

- ·Cô gái trẻ ở Thanh Hóa lừa tiền từ thiện của hàng trăm nhà hảo tâm

- ·Cảnh báo nguy cơ mất cắp thông tin tài khoản ngân hàng

- ·FPT khai trương trung tâm xuất khẩu phần mềm lớn nhất Việt Nam

- ·HSBC có thị phần ngoại hối tốt nhất Việt Nam

- ·Ngân hàng CSXH chi nhánh TP.HCM tròn 10 năm hoạt động

- ·Siemens khởi động Giải thưởng báo chí về Công nghệ xanh

- ·Nhật Bản cảnh báo người tiêu dùng về bão hàng giả các thương hiệu nổi tiếng

- ·Bị bạo hành, mẹ rủ con trai giết chết chồng cũ